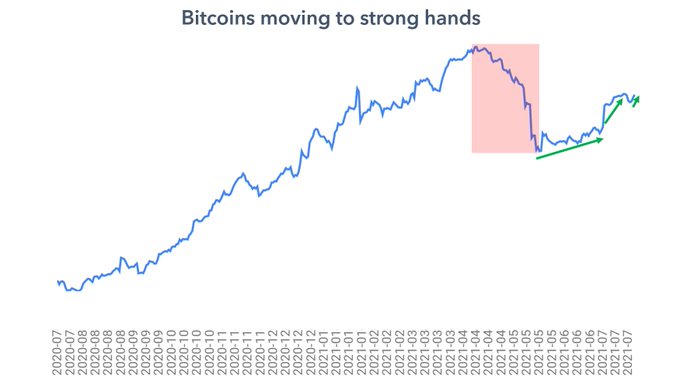

Bitcoin is Moving to Strong Hands as Small Holders are Proving to be a Rising Force

Bitcoin has found itself in a swing position for more than two months now based on its stagnation in the $30-$40K range. This situation has been caused by low volatility and intensified crackdown on crypto mining by Chinese authorities.

The battle between long-term and short-term holders has also played a part in their contrary positions in the BTC market. For instance, as long-term BTC holders kept on accumulating, their short-term counterparts continued selling, resulting in a stalemate.

However, on-chain analyst Will Clemente believes that Bitcoin is moving to strong hands given that its supply shock is at levels witnessed at the $50-$60K range.

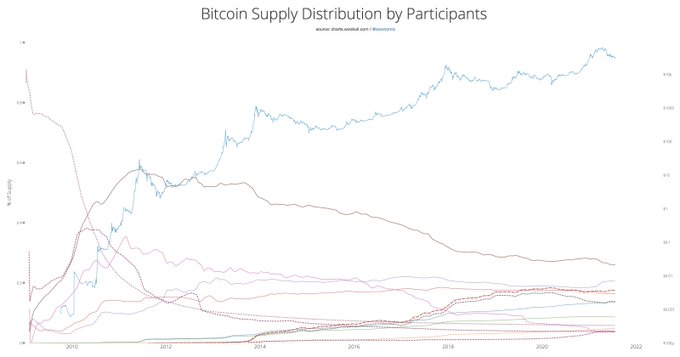

Strong hands are investors who indulge in an asset for future purposes other than speculation. Smallholders are a rising force. According to crypto analyst Willy Woo:

“ Bitcoin continues a 12 year trend of distributing evenly. Small holders are a rising force.”

Therefore, smallholders cannot be ignored as they sold 428,749 BTC in May, and this is one of the reasons why Bitcoin nosedived from a record-high of $64.8K hit in mid-April. Moreover, on May 19, BTC shed off 30% of its value on a single day, making it go below the 200-day MA indicator for the first time since March last year.

Bitcoin’s short-term interest declined by 43% from an all-time high (ATH) experienced in February, triggering low volatility in the market.

As a result, crypto trading volumes in exchanges dropped by more than 40% in June. For instance, spot trading volumes fell by 42.7% to $2.7 trillion, while derivative volumes dropped by 40.7% to hit $3.2 trillion.

With Bitcoin moving back to strong hands, it remains to be seen whether this jumpstarts the top cryptocurrency back to winning ways.

Image source: Shutterstock