Bitcoin Needs to Create a Higher-Low at $31K for an Upward Trend, says Market Analyst

The news about Bitcoin (BTC) ranging between the $30K and $40K levels has continued for weeks. The top cryptocurrency found itself in this territory after plummeting from an all-time high (ATH) of $64.8K recorded in mid-April.

Bitcoin recently broke this level and dropped below the psychological price of $30,000 to hit lows of $29K.

Nevertheless, BTC regained some momentum following Elon Musk’s disclosure during the B-Word virtual event held on July 21 that SpaceX aerospace manufacturer had invested its treasury reserves in BTC. Tesla was likely to begin accepting BTC payments again.

Therefore, Michael van de Poppe believes that Bitcoin should create a higher low at $31K for an upward trend to be ignited. The market analyst explained:

“Bitcoin is looking better on multiple timeframes, but still, more confirmation is required to state that we’ve got a temporary low or even cycle low. That means a higher-low at $31,000 could provide a trigger. Such a trigger will also blast Altcoins upwards again.”

Higher-highs and higher-lows signify an uptrend, whereas lower-highs and lower-lows show a downtrend in a tradable asset.

Michael van de Poppe trusts that an uptrend in the BTC market will prompt a price surge in altcoins.

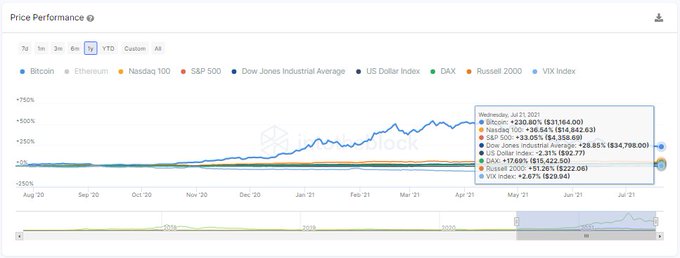

Bitcoin is still up by 230% over the past year

Despite the sharp Bitcoin price drop witnessed recently, from highs of $64.8K to lows of $28K, the leading cryptocurrency is still up by 230% in the last year. As a result, outperforming traditional western finance indices.

Data science firm IntoTheBlock stated:

“BTC’s price is outperforming traditional finance indices in spite of recent volatility. Even after a 50% drop in price followed by a back and forth in the 30K range, BTC’s price is still 230% up in a one-year time frame, growing quicker than traditional western finance indices.”

Bitcoin was up by 2.78% in the last seven days to hit $32,513 during intraday trading, according to CoinMarketCap.

Therefore, time will tell whether the much-needed upward momentum will be triggered soon as Bitcoin’s consolidation for more than two months continues.

Image source: Shutterstock